Bloomberg hosts a conference Thursday on the investment opportunities given securities market integration in Latin America (MILA). The conference will be held at the New York Academy of Sciences and streamed live on Bloomberg Professional. A complete list of panels and speakers is available on the Bloomberg Link site.

As a speaker on the 11am panel, with Blackrock’s Head of Latin America Daniel Gamba and Candente Copper’s CEO Joanne Freeze, I have been looking back through some prior research to prepare for the conference. Published below are my thoughts on the market opportunities in the region and some data that I will use during remarks at the conference.

MILA stands for Mercado Integrado Latinoamericano, or Integrated Markets of Latin America. In May of this year, the stock exchanges of Chile, Colombia, and Peru began a system of integration of their equity trading. Through a FIX protocol messaging service, brokers in the three countries can trade shares through agreements with local brokers within the markets. The goal of the integration is to create economies of scale and scope for equities trading on the exchanges and firms operating within the region. The initiative makes for the largest market in Latin America in terms of number of issuers and the second largest by market capitalization. As a result of the integration, the MILA market will have a lower correlation with the MSCI World Index than either the Brazilian or Mexican markets, meaning a greater level of diversification for portfolios. Further comparison of the MILA market with other indices shows less volatility as well. Using returns from 2002 to 2008, the MILA market has an annualized standard deviation of 17% compared with the MSCI LatAm (33%) and the MSCI World (21%).

Many are comparing the MILA integration to the creation of Euronext in 2000. Research on efficiency gains from the Euronext formation by Marco Pagano (2005, pdf) shows that a reduction in volatility and increased liquidity helped Euronext reduce costs of trading by an average of between 15% and 31% for the participating exchanges and a reduction in bid-ask spreads of between 23% and 48%. Investors in equities listed on the Euronext saw increased liquidity, higher prices, and a lower equity risk premium.

An earlier article posted on Seeking Alpha details the MILA and a few ADRs available to American investors, and the full report on the integration is available on the Efficient Alpha website. Though the news lately has taken a backseat to the crisis in Europe, regional heavyweights Brazil and Mexico have said that they also would like to join the integrated market.

The panel on which I will be participating is called, “Funding the Next Big Thing: Hidden Gems in the Andes,” and will detail the opportunities of increased capital and liquidity for companies possibly leading to increased IPO activity and outperformance in specific sectors. Traditionally, smaller firms and those outside the more popular sectors have not had access to the capital markets. The sheer size and diversity of issuers within the new market may help increase growth capital across sectors.

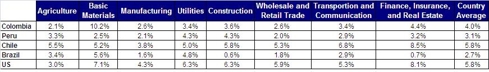

Productivity Growth by Sector

An article I posted to Seeking Alpha about a month ago analyzed the growth rate in productivity across eight sectors and by country since 1980 (shown in the table below). The analysis included Brazil, Colombia, Chile, Peru, and the United States. One would expect that the lesser developed markets, in terms of capital allocation and efficiency, would have higher growth rates in productivity than the more developed market. This has not been the case over most sectors and is a major contributor to the widening gap between Latin America and the United States in terms of income per capita.

Notable standouts are within agriculture and basic materials, where regional productivity growth is higher than in the United States. In all other sectors: manufacturing, utilities, construction, wholesale & retail trade, transportation & communication, and finance & real estate the region has seen growth rates of less than two-thirds those of the developed market. Chile has done relatively well with average productivity growth equal that of the U.S., but the other three countries lag the developed market’s rate of 5.8% considerably with rates of 4.0%, 3.1%, and 2.7% for Colombia, Peru, and Brazil respectively. Playing average productivity growth rates would lead to a long in country funds for Chile and Colombia with a short on Brazil. Though Peru also sports relatively low productivity growth rates, the market stands to benefit from market integration.

The MSCI Brazil Fund (EWZ) holds 86 securities and charges an expense ratio of .61%. Sectors are concentrated primarily in four areas: financials (23.5%), materials (23.0%), energy (20.9%), and consumer staples (10.6%). The average price to book value of the fund is 2.9 and has lost 23.4% of its value over the last twelve months, making it not only the biggest decliner of the three country funds but also still the most richly valued.

The Global X FTSE Colombia 20 (GXG) holds the 20 most liquid stocks on the Colombian market and charges an expense ratio of .68%. The fund is also highly concentrated but reflects the local market with: financials (41.2%), energy (17.1%), industrials (10.7%), utilities (9.6%), and materials (9.0%). The average price to book value of the fund is 2.6 and has lost 7.1% of its value over the last twelve months.

The iShares MSCI Chile Market Fund (ECH) holds the 39 most liquid stocks on the Chilean market and charges an expense ratio of .61%. The fund is slightly more diversified across sectors than the other country funds with: utilities (24.9%), industrials (19.2%), materials (18.5%), consumer staples (13.1%), financials (12.5%), and consumer discretionary (6.6%). The average price to book value of the fund is 2.7 and has lost 16.3% of its value over the last twelve months. The fund’s 19.7% allocation to consumer goods will help protect it from global growth problems related to the U.S. and Europe.

Investment in construction may benefit from the region’s need for infrastructure build-out. Additionally, the increase in availability of capital for the sector may bring the machinery that will help drive higher productivity growth going forward. Financials could benefit most directly from the regional integration as trading costs come down and participation increases. Low loan penetration relative to other markets could also help to support financials as the sector develops its practices and products. The region’s success is still heavily tied to basic materials and investors should understand that slower global growth may detract from regional growth regardless of integration efforts. Two ADRs available to investors in the banking space include Banco de Chile (BCH) and Bancolombia (CIB). Investors could pair a long investment in the Chilean and Colombian bank ADRs against a short in the Global Emerging Market Sectors (FGEM). The fund tracks the Dow Jones Emerging Markets Financials Titans 30 Index and holds securities in: China (37.7%), Brazil (16.6%), India (13.6%), South Africa (11.3%), Turkey (6.4%), Malaysia (5.7%), and Poland (5.0%). Though emerging market financials in general may outperform developed market financials, Chilean and Colombian banks should do relatively well given macroeconomic fundamentals and effects of integration.

Access to Capital

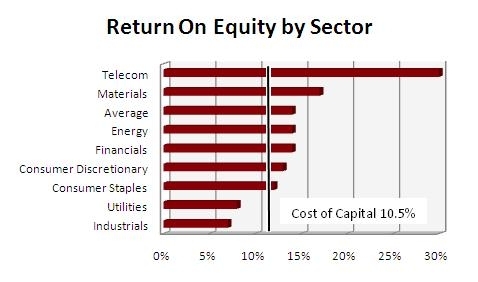

If we compare return on equity with the cost of capital by sectors within the region, we get a sense of profitability. Returns above the cost of capital are referred to as economic profit, and play a key role the price appreciation of equities. Using bond yields in the region to estimate an average cost of capital of about 10.5%, the chart below shows per sector results with telecom as the best performing and utilities as the worst performing sector. On average, the region’s sectors generated a return on equity of about 14% above the cost of capital.

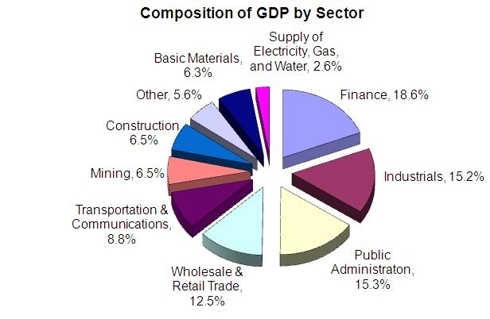

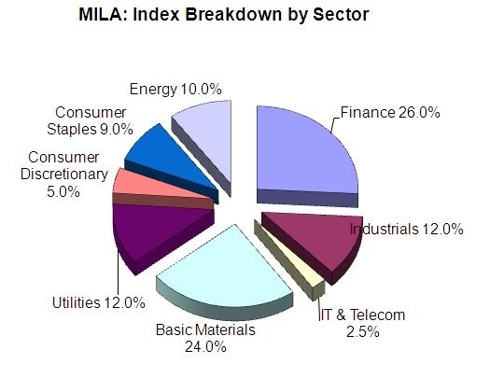

Using data from Bancolombia and the U.N. Economic Commission for Latin America, we can compare the sector weights of equities within the integrated markets and sector compositions as a percentage of GDP. Though the sector definitions within the data do not match up exactly, we can still see relationships between the two charts below. The capital market sector weights in a well-functioning market should mimic those weights as a percentage of GDP. The capital markets in Chile, Colombia, and Peru have traditionally favored basic materials, energy, and the financials. Conversely, it appears that information technology & telecom and consumer products are not represented in the capital markets as highly as they should be given GDP proportions. This helps investors get an idea of which sectors may be relatively neglected in terms of access to capital. Given increased liquidity and trading volume, the MILA market could increase IPO activity within the region. Those sectors, consumer goods and telecom, may benefit from increased access to funds.

Given their historically favored status; the energy, agricultural, and basic materials sectors are all more highly developed and tend to trade more in line with global events. Currently, the debt crisis in the European peripherals and lower expectations of growth in the U.S., are acting as headwinds to these sectors. Companies serving the domestic market, again consumer goods and telecom, should outperform on a relative basis due to integration effects and strong internal demand.

With the market having already seen its dramatic rebound from the bear market trough, the returns to Latin American markets going forward could be fairly modest. The iShares S&P Latin America 40 (ILF) has increased 73% from its ’08 lows but has declined by -16.5% to date this year. The fund is not well diversified across Latin America with country holdings of: Brazil (55.7%), Mexico (26.6%), Chile (12.0%), and Peru (5.5%). Exposure to the Mexican market means the fund will be more closely tied to the U.S. economic story than some of the country-specific LatAm funds.

The region has made vast improvement over the last decade in monetary and fiscal policy. While the region still has a ways to go to achieve self-sufficiency in economic growth, it has diversified its main trading partners somewhat and consumer demand is growing. Given possible performance in the MILA markets relative to the rest of Latin America, investors may want to hedge global economic concerns by shorting the Latin American fund and going long the Global X FTSE Andean 40 (AND). The Andean fund holds the 40 most liquid equities in Chile, Colombia, and Peru and charges an expense ratio of .72%. The fund tracks the new MILA exchange closely with country weights of Chile (51.0%), Colombia (33.4%), and Peru (15.5%). Sector exposure also mimics the integrated exchange, though with some tracking risk, with: materials (26.4%), financials (24.3%), consumer goods (12.6%), utilities (12.4%), energy (12.0%), and industrials (10.2%).

While events in Europe could drive prices down on a risk trade, the long term fundamentals are positive for most in the region. Policy makers in Europe have shown they are unwilling to aggressively fight their debt problem with any quantitative easing and have instead tried to calm markets with supportive statements in the press and a series of emergency grants. I doubt that the region has the willingness to embrace austerity measures needed to solve the imbalances and fully expect some form of restructuring. This will bring emerging markets down sharply, but after a short stall the Latin American growth engine will move into second gear and rebound as it did following the last recession. Many of the central banks have postponed their rate increases due to lowered expectations of global growth, which should benefit those interest rate-sensitive sectors like financials. The region is also sitting on historic levels of reserves which will help to alleviate global economic pains. According to IMF data as of 2009, the region had total reserves of a little over 20% of GDP compared to around 5% in 2000.

Beyond positive regional fundamentals, the markets of Chile, Colombia, and Peru should benefit from higher liquidity and investor interest. Investors should focus on those sectors that have been historically neglected in the capital markets or those that could benefit most from integration. Economic profit, a key driver of growth, has not been consistent across sectors and may also provide investors with opportunities in specific stocks.

Seeking Alpha.

No hay comentarios:

Publicar un comentario